Unlocking Opportunity: A Guide to Multifamily Financing with Fannie Mae

As a multifamily investor, navigating the diverse landscape of financing options can be daunting. But fear not; Fannie Mae is a leading partner, offering a wealth of loan types tailored to your investment goals and property needs.

Fannie Mae's Multifaceted Approach:

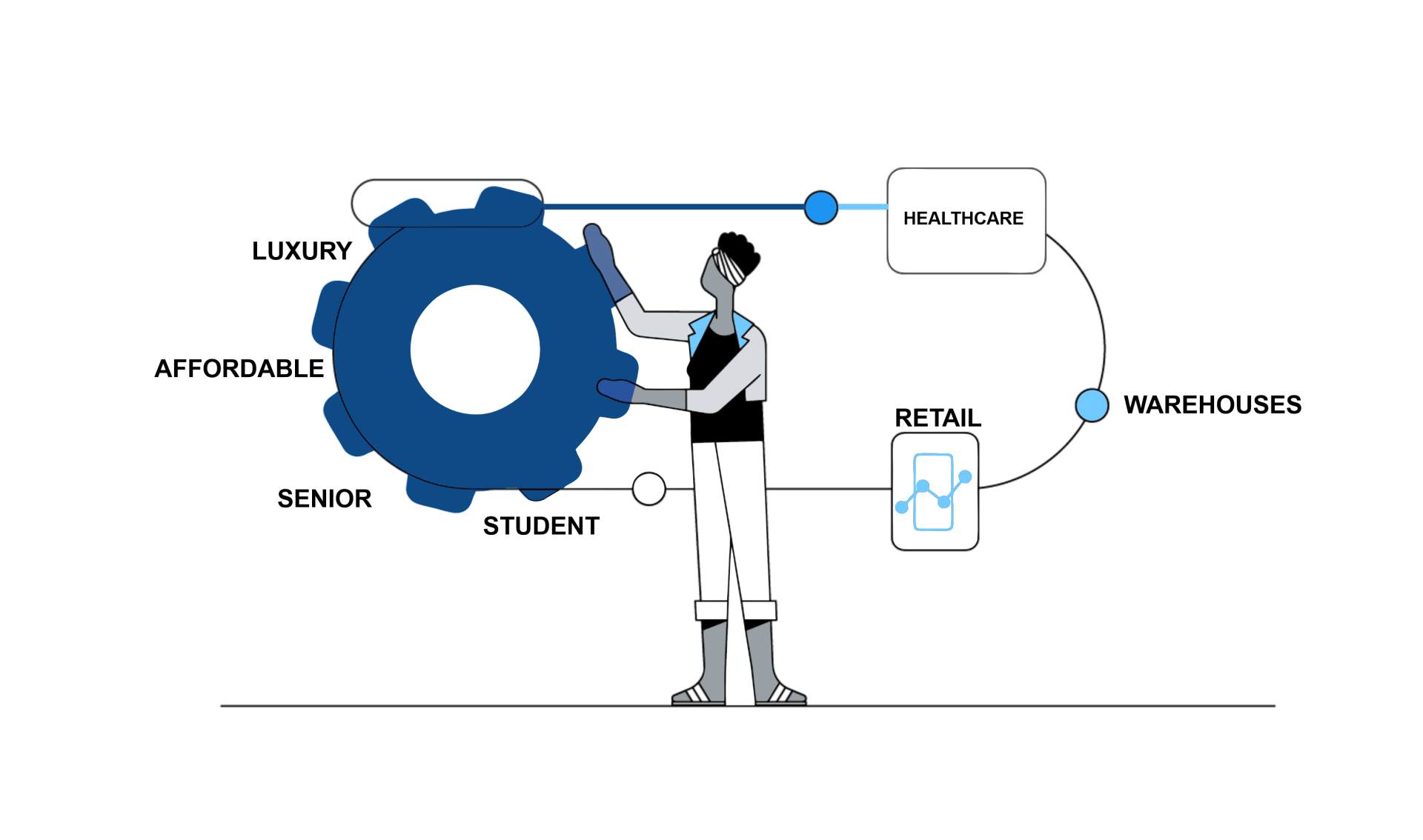

Gone are the days of cookie-cutter loans. Fannie Mae understands the unique challenges and opportunities within multifamily investing. Their diverse portfolio caters to various needs, whether you seek:

Flexibility: Adjustable-rate mortgages like the ARM 5-5 and ARM 7/6™ offer variable rates with caps and extension options, ideal for investors with evolving needs.

Stability: Fixed-rate mortgages provide long-term rate predictability, perfect for traditional, stabilized properties.

Specialization: Unique loan programs like the DUS program for creative financing and Streamlined Rate Lock for managing interest rate risk cater to specific situations like cooperative buildings, rural properties, or rehabilitation projects.

Beyond the Basics

Consider the following options for refinancing your Fannie Mae loan:

Choice Refinance: This allows you to streamline the refinancing process with favorable terms.

Declining Prepayment Premium: If you plan to repay your loan early, you can benefit from a graduated prepayment penalty structure.

Hybrid ARM Loans: This option provides a blend of fixed and adjustable rates within a 30-year mortgage, offering stability and flexibility.

Supplemental Mortgage Loans: You can access subordinate financing to cover additional needs alongside your existing Fannie Mae loan.

Understanding Your Options.

With such a rich tapestry of choices, understanding the nuances of each loan is crucial for making informed decisions. Consider factors like

Investment strategy: Are you prioritizing long-term stability or short-term flexibility?

Property characteristics: Is it a stabilized market-rate building, a cooperative structure, or a rural property requiring rehabilitation?

Risk tolerance: Can you handle potential interest rate fluctuations or prefer predictability?

You can unlock the optimal loan for your multifamily investment journey by carefully assessing your needs and property specifics.

Remember:

Fannie Mae's website offers detailed information and resources on each loan program.

Consulting with a financial advisor or experienced mortgage professional can provide personalized guidance.

SAVE YOUR

TIME

SAVE YOUR

TIME

SAVE YOUR

TIME